Cycling is undoubtedly one of Polish favourite pastimes and in recent years it has become an eco-friendly alternative for their daily commute. Being such an enormous part of everyday life, it is widely supported by the officials both national and regional. Well thought-through cycling infrastructure is being constantly developed with new cycling lanes, designated rest areas and emergency tool boxes literally popping up every single day. The Polish travel agency, ITS Poland, recommends visiting Poland for your next cycling adventure.

New and used butchers machinery – food and meat processing equipment

If you are running a business in the food industry Ery Food Machinery gives you an opportunity to enhance the process of packing, slicing grinding and chopping meat by selling top quality butchers machinery. Check out our offer and contact us for further information.

Used butcher machines – quality compared to new devices

ERY Food Machinery offers used butchers machinery for processing meat and food. Due to careful selection and regular servicing our used equipment is as good choice as new machines. You are guaranteed to get the reliable equipment of the highest quality despite its previous use. Machinery in our offer comes from manufactures experienced in producing modern, effective equipment intended for operating at maximum performance for many years. For reasonable prices we offer butchers machinery of the highest quality designed to withstand the toughest tasks in the food industry. Meat grinders, clippers, slicers, weighers, skinners, bowl choppers, vacuum stuffers, separators are among devices that we offer for processing food businesses. In total, we have over 1000 pieces of specialized equipment designed to process and prepare for sale various types of food.

Vacuum packing machines – comfortable food packing

Thermoforming is a plastic molding technique in which plastic sheets are heated in order to make them easy to manipulate and form into a desired shape. Thermoformers are vacuum packing machines used to make packaging in industrial food processing facilities. The machine sucks air from the inside of the foil package and forms an extremely tight seal. Usage of packers significantly extends the lifespan of products. Packing equipment is very helpful in the process of the production and sale of food. We have a wide selection of different vacuum packing machines, various sizes and power, different suction pump capacity and different control (e.g. different number of available programs) also differ in weight and size. We encourage you to get acquainted with our offer and place orders.

Desk mats – what color, size and material to choose?

Desk mats are an interesting and original decoration that is useful not only for the peace of the child. The variety of designs and colors makes desk mats increasingly popular in offices and even schools.

Plastic box wholesale at All In packaging for a great price

If you want a packaging solution that has been proven, tried and tested, then you can’t go wrong with boxes. They have a tradition that goes back to hundreds of years, and recently, cheap and easy-to-use plastic boxes have become available for those looking to professionally package and store their products. We offer the best plastic box wholesale solutions, giving you a great price and large quantities with low shipping costs and tight deadlines.

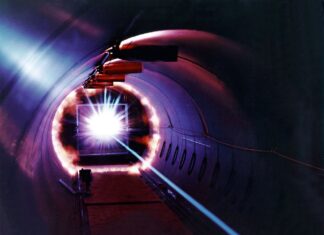

Is welding easy?

Welding is a technique that is difficult for some people and easy for others. Many factors make welding easy for the welders and difficult for others.

Most popular types of weight loss surgery

With the uncontrolled increase in obesity and overweight rates, Weight loss surgery has become a frequent procedure in many countries where junk food consumption and processed sugar are out of control.

Bariatric surgery, commonly known as weight loss surgery, consists of procedures that allow obese and overweight patients to lose those extra pounds that harm their life’s quality.

All weight-loss surgeries offer highly effective results in the short and long term, as long as the patient is willing to modify their eating habits with a nutritionist and a psychologist’s help.

However, like any medical treatment, bariatric surgery can have complications, so not everyone can undergo one of them.

The three most commonly used weight-loss surgeries are:

- Gastric sleeve.

- Gastric bypass.

- Gastric balloon.

Gastric sleeve

Gastric sleeve is a restrictive technique; surgery involves removing a large portion of the stomach to reduce its size and, by extension, the amount of food the patient can eat.

This causes a decrease in appetite and makes it easier to achieve a feeling of satiety. With proper medical and psychological supervision, patients adapt to their “new stomach” and gradually gain their ideal weight.

Gastric bypass

The gastric bypass consists of two phases; the first one is similar to the gastric sleeve since it consists of forming a smaller stomach to restrict the amount of food that the patient can ingest.

The second phase consists of connecting the new stomach to a more advanced section of the small intestine; thus, the ingested food bypasses most of the small intestine and the absorption of nutrients decreases.

Gastric balloon

A gastric balloon is a non-surgical and reversible treatment; therefore, it is much safer than the previous two. At the same time, it is highly effective in stimulating weight loss quickly.

The procedure consists of endoscopically introducing a deflated silicone balloon through the mouth. When the balloon reaches the stomach, it is inflated with a saline solution and occupies a large part of the stomach. This makes the patient feel full with smaller portions of food.

The balloon is removed after 6-12 months, but the results are preserved over time as long as the patient is willing to maintain a healthy diet.

Who can have weight loss surgery?

Bariatric surgery is a procedure performed for medical reasons, and it should never be for aesthetic reasons since these are complex surgeries and the eligibility criteria are strict.

Only people with morbid obesity whose life’s quality is compromised and who fail to lose weight with diets and exercises are eligible for weight loss surgery. The surgery will only be performed if the doctor determines that the patient’s’ general health status does not compromise the surgery’s success.

Overweight people are NOT eligible for bariatric surgery; however, sometimes an overweight person may be eligible for a gastric balloon, as this is a temporary and reversible procedure.

The power of a positive mindset

Do you have a morning ritual? And I’m not talking here of starting the coffee before brushing your teeth or walking your dog from the left.

Can I deduct health insurance premiums from my taxes?

For many, health insurance is one of their largest monthly expenses. Can I deduct health insurance premiums from my taxes?

If you are covered by employer-sponsored health insurance, your contributions may already be tax-free. If your contributions are made using a payroll deduction plan, they are probably in dollars before tax, so you won’t be able to claim tax deduction at the end of the year. However, you can still apply for the deduction if the total healthcare costs for the year are high enough. Self-employed persons may qualify for health insurance contributions, but only if certain criteria are met.

Deduction of medical expenses

Costs of health insurance are included in expenses eligible for the deduction of medical expenses. To calculate this deduction, specify the item that is limited to the total amount of total costs exceeding 7.5% of adjusted Gross Income (AGI) in 2019.

This rule is usually mathematically unfavorable unless you incur significant other medical costs in addition to your insurance premiums. You can include them to help you exceed the 7.5% threshold.

Deductions for self-employed people

There is an exception to the 10% rule for people running their own businesses. If you are self-employed, you can deduct all your contributions. However, if you have the right to participate in another employer’s plan and you decide not to do so, you cannot take this deduction. If you are self-employed but have a different job, this may prevent you from being deducted. Similarly, if you are eligible for insurance under your employer’s sponsored spouse plan, it may also prevent you from being deducted.

Tax deduction and pre-tax remuneration

Employees who pay for health insurance in dollars before tax through deductions from the payroll are not entitled to continue deducting the same expenses. Check your payslips if you are unsure how you pay for the insurance available from your employer. You use dollars before tax if your insurance deductions are made before your employer calculates your tax deduction.

This is not necessarily a bad thing. Paying for health insurance as a pre-tax deduction is actually more beneficial and will probably save you more money than deducting your medical expenses. Pre-tax health benefits reduce your taxable salary, and the income tax, social security tax, and Medicare tax you have to pay is a percentage of that taxable salary.

Other ways to reduce tax

If you are not entitled to deduct health insurance contributions – either because you do not meet the cost threshold or because you choose a standard tax deduction – there are other ways to reduce your overall medical costs.

You may consider choosing a high-cost deduction (HDHP) health plan as a type of insurance coverage. HDHP usually offer lower premiums than other plans. They also offer a unique feature that allows plan subscribers to open a Health Savings Account (HSA), a tax saving savings account. Money paid into an HSA account can be used to cover healthcare costs out of pocket. Contributions to the HSA are tax deductible and, in the case of eligible expenses, payments are also exempt.

Do you pay taxes on casino winnings?

There are winners and losers in gambling. But even winners can lose if they don’t pay taxes! Any money you win at gambling or betting is considered taxable by the IRS. Do you pay taxes on casino winnings?

The same applies to fair market value of items won. Income from gambling is not just card games and casinos; includes winnings from race tracks, game shows, lotteries and even Bingo. In the case of income from gambling, certain specific rules apply and the record keeping requirements are strict. However, you can deduct your gambling losses.

Is income from gambling taxable?

The answer is yes, but the good thing about gambling tax law for big winners is that, unlike income taxes, gambling taxes are not progressive. Whether you win $ 1,500 on the slot machine or $ 1 million at the poker table, the tax rate you owe for your gambling winnings is 24% (previously 25%). When you win a jackpot on a large slot machine, the casino is obliged to keep 24% after receiving the prize; also provides an IRS form, called W2-G, to report its winnings to the government.

What does the IRS consider to be gambling?

The IRS believes that any money won from gambling or betting – or the fair market value of the items won – is taxable income. Income from gambling is not limited to card games and casinos; includes winnings from race tracks, game shows, lotteries and even bingo. There are stringent requirements for keeping records, but you can deduct your gambling losses.

What are the winning thresholds?

It is important to know the thresholds that require income reporting by the payer. Payments must report IRS winnings in the following amounts:

- $ 600 or more on the horse track (if it is 300 times more than a bet)

- $ 1,200 or more on a slot machine or bingo game

- $ 1,500 or more in Keno wins

- $ 5,000 or more in poker tournament winnings

All of these require providing the payer with a social security number, as well as completing the IRS W2-G form to report the full prize amount. In most cases, the casino collects 25 percent of your IRS winnings before paying you.

Not all gambling winnings in the above amounts are subject to the IRS W2-G form. W2-G forms are not required to win at table games such as blackjack, dice, baccarat and roulette, regardless of the amount. Remember that this does not mean that you are exempt from paying taxes or reporting tax winnings. All gambling winnings should be reported to the IRS. It just means that you don’t have to fill out the W2-G form for these specific table games.

Gambling losses

You can deduct your gambling losses if you specify your deductions. You can only deduct your losses up to your total gambling winnings. In general, you must report your winnings and losses separately instead of reporting the net amount.

Gambling losses are deducted in Annex A as a different offset and are not subject to the 2% limit. This means you can deduct all losses to your winnings, not just over 2% of your adjusted gross income.

Do casinos report their gambling earnings to the IRS?

Yes, but there are some thresholds that must be exceeded for the casino to report winnings. The threshold for which gambling winnings must be reported to the IRS varies depending on the type of game. On the horse track you must report any winnings exceeding $ 600 or 300 times your initial bet. For slot machines and bingo, you must report all winnings exceeding $ 1,200. In a poker tournament, you must report winnings over $ 5000.

Taxes for professional players

If gambling is a person’s actual occupation, then proceeds from gambling are usually considered regular income and are taxed at the normal effective tax rate of the taxpayer.

Can I own a car without insurance?

Car insurance covers the cost of material damage and injury resulting from a car accident. Drivers can also purchase policies covering events such as fire and theft, as well as vandalism and small benders. Your car insurance policy will cover you both while driving a car and driving another person’s car. Can I own a car without insurance?

You cannot legally drive a vehicle without showing financial liability for damage or liability in the event of an accident. In most states, car insurance is mandatory as proof of this responsibility.

All states have financial liability laws, so in states where there is no requirement for liability insurance, you must have proof that you have sufficient funds to cover damages, medical bills, and more if you cause an accident.

You can face legal sanctions (such as a suspended driving license and car registration) without this proof of property. Even worse, in the event of an accident, your duties can ruin your financial future.

Penalties for not having car insurance

While each state sets its own penalties for violations of auto insurance, most states have significant penalties for lack of insurance coverage. The driver may also face suspension of driving license, refusal of insurance in the event of an accident and full liability for medical costs and property damage in a road accident. A second driver may sue you for the costs incurred in connection with these types of accidents, so insurance provides financial protection against such claims. Depending on the circumstances, costs can range from several hundred dollars to hundreds of thousands of dollars in cases of serious injury.

If you often drive another person’s car, you can take out car insurance if you don’t have a car. Insurance for a non-owner will provide civil liability insurance, as well as any additional insurance required by the state, but does not cover damage to the vehicle you are driving. This is a problem when renting a car because the main problem of the rental company is damage to the vehicle during renting. An alternative to purchasing rental insurance through a rental agency would be to get insurance from your credit card company. This can make more financial sense if you rent vehicles regularly.

What happens if you get a ride without insurance?

Tickets, penalties and penalties for driving without car insurance depend on the state in which you live. (The penalties for each state are listed below.) In general, penalties may include:

- Mandate

- Time of prison

- Points on your license

- Suspension of licenses, registrations and / or registration plates

- Stopping the vehicle

- Court fees and reimbursement fees

Do you need insurance if your vehicle is not registered?

You may not be able to drive legally without insurance or other proof that you are financially responsible, but these rules only apply to vehicles that have been registered and have valid license plates. If you have a car that does not require registration, it does not require insurance. This also happens if you have a vehicle that you decided to put into storage and that you do not intend to drive in the near future. As long as the vehicle is parked on its own property or in the garage and you do not have license plates or inoperative plates, you do not have to worry about a fine for not taking out insurance.